About

History

Schachter Energy Research Services Inc. is a Calgary Alberta based company that was originally created in 1996 as Schachter Asset Management Inc. It was renamed in 2017 when the Schachter Energy Report was launched.

We provide expert, independent research targeted to individual investors interested in the Energy sector. Our reporting includes

- Market overviews on global events impacting stock markets, economic trends and ultimately the price of Oil and Gas,

- Energy Sector updates highlighting trends and issues affecting energy companies and energy specific markets

- Coverage of Canadian- based companies in the areas of: Exploration & Production, Energy Services, Royalties, Infrastructure & Pipeline, with analysis of quarterly and year end reports, plus comparative financial and valuation information on all the companies.

Our intent is to help active retail investors choose companies that will thrive in the current ENERGY SUPER CYCLE that is expected to last until the end of this decade, and to expose companies with high returns potential to as many investors as possible, as there is currently very little exposure for individual companies to the retail market.

To augment our twice monthly Schachter Energy Report and the weekly Eye on Energy publications, we offer an in-depth 90 minute Black Gold Webinar with Q&A each quarter and our annual Catch the Energy Conference where investors can interact ‘face to face’ with the CEOS of up to 45 energy related companies of today and tomorrow.

Josef Schachter also makes keynote speeches and corporate presentations to organizations and at conferences across the country.

The companies covered by Josef Schachter do not pay him for publishing research, nor does he receive stock grants or options from those companies.

Josef Schachter’s research is focused on benefiting subscribers by giving them independent and objective investment research to assist subscribers in making informed investment decisions with the help of their investment advisors.

CORE Values

Integrity in the way we conduct and present our independent research

Transparency in our business dealings with subscribers, providers and the companies we cover

Value-added information and analyses helping companies and individual investors manoeuver through stock market and energy sector cycles

Research Process

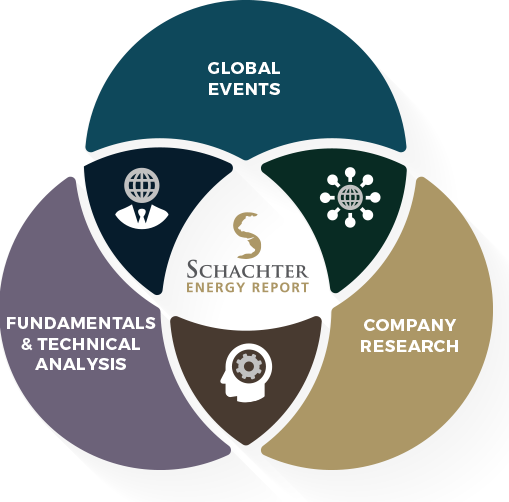

Josef lives at the intersection of big picture thinking, technical and financial analysis and on the ground common sense.

Global

Events

- Worldwide demand

- Storage levels worldwide

- Regional Insurgencies

- ISIS and other terrorist activities in oil producing countries

- Failing or corrupt governments

- World Banks’ activity

- Currency fluctuations

- US$

- OPEC and non-OPEC producer strategies

- LNG activity

- Impact of Sanctions

- Climate Change Issues

- Geo-political issues

- Pipeline access

- Facilities & Pipelines construction timelines

- First Nations’ issues impact on production growth

- Widening or shrinking contangos

Company

Research

- Knows the CEOs and Executives

- Meets with companies

- Visits sites when required

- Easy Phone Access

- Reputation: honesty and integrity

- Projects make sense

- Knows Team History

- Analyses: quarterly & annual financial reports

- Attends company presentations & conference calls

- Reviews legal filings

- Support of Bankers and suppliers

- Low operating Costs

- High Impact Exploration Upside

- Manageable decline rates

- 1P & 2P Reserve Life Indices

- Growing Production

- Balance Sheets show Financial Capacity

Fundamentals &

Technical Analysis

- Bullish/Bearish Indicators

- Rig Counts

- Oil & Gas Charts

- WTI Charts

- Injection Charts

- Historical Knowledge

- Net Asset Value

- Reserves Analysis

- Book Value vs Historical trading ranges

- S&P Energy Bullish Percentage Index

- Supply and Demand Cycle

- Energy Indices

- Futures Positions of speculative and commercial positions

- Individual Company Stock

- Charts and trends

Three variables must be taken into account to come to an overall energy sector rating: the Value, Sentiment and Technical conditions of the sector.

- Value means that companies in general have attractive valuations versus historic financial measures, such as low operating and finding costs, growing production, cheap on a price to net asset value or book value, stable and improving balance sheets, and meaningful growth plans.

- Sentiment The S&P Percentage Bullish Index indicates where we are in the sentiment cycle. When the indicator is above 90% it highlights a market in frenzy and a top is likely thereafter. When the indicator is below 10% bullish it indicates a high level of fear, and that is precisely when it is the best time to invest.

- Technicals We use technical analysis tools to identify high and low risk entry points for the sector and for individual stocks. We look to see if the current stock price is cheap or expensive versus historic measures including energy commodity prices.

When these three factors become aligned and all give a green light, ones chances of making low risk, high reward investment decisions are improved.

Josef Schachter

As a 40+ year veteran of the Canadian Investment Management Industry, Josef Schachter has experienced several exceptional and turbulent global economic and stock market cycles. With his primary focus in the stock market and the energy sector, Josef is able to weave global political, economic and monetary issues with current energy data into a compelling story of what’s going on, what is to come, and why.

Josef is a frequent guest on Michael Campbell’s Podcast ‘Mikes Money Talks’ and other podcast and radio shows and is often quoted in the media. He is a regular Guest Speaker at the annual World Outlook Financial Conference in Vancouver and he delivers presentations to various companies and organizations. For several years, he was a frequent and and notably colourful commentator on BNN Bloomberg’s Market Call.

Josef provided Oil and Gas research to Maison Placements Canada geared to their institutional clients for 15 years ending April 2017, and was acknowledged as the first analyst in Canada to predict the Oil Price Plunge of 2014.

Prior to establishing his firm Schachter Asset Management Inc. in 1996, Josef was the Chief Market Strategist at Richardson Greenshields, a Director of RGCL and a member of its Investment Policy Committee. He holds a Chartered Financial Analyst designation and is a past Chairman of the Canadian Council of Financial Analysts.

Josef on Linkedin

Josef on Twitter

The Schachters Open the TsX, 2023

Speaking Engagements

Inquire

- Conference Speaker

- Corporate Presenter

- Keynote for Association Meetings

- Television commentator

- Strategic Industry Advisor